banks observed during 56 quarters, we test for Granger non-causality between banks’ profitability and cost efficiency.Wiley is a global provider of content and content-enabled workflow solutions in areas of scientific, technical, medical, and scholarly research professional development and education. Finite-sample evidence shows that the resulting approach performs well in a variety of settings and outperforms existing procedures.

Subsequently, a Wald test is proposed, which is based on the bias-corrected estimator. In order to account for the well-known “Nickell bias”, the approach makes use of the well-known Split Panel Jackknife method. Pooling over cross sections guarantees that the estimator has a NT convergence rate. Therefore, we put forward a pooled least-squares (fixed effects type) estimator for these parameters only. The novelty of the proposed approach lies in the fact that under the null hypothesis, the Granger-causation parameters are all equal to zero, and thus they are homogeneous. The method is valid in models with homogeneous or heterogeneous coefficients.

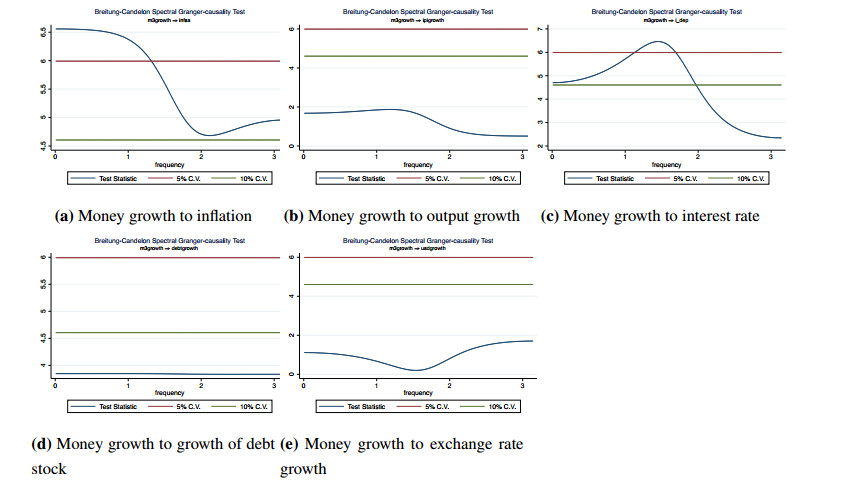

#Granger causality testing series

banks observed during 56 quarters, we test for Granger non-causality between banks’ profitability and cost efficiency.ĪB - This paper develops a new method for testing for Granger non-causality in panel data models with large cross-sectional (N) and time series (T) dimensions. N2 - This paper develops a new method for testing for Granger non-causality in panel data models with large cross-sectional (N) and time series (T) dimensions. T1 - A homogeneous approach to testing for Granger non-causality in heterogeneous panels banks observed during 56 quarters, we test for Granger non-causality between banks profitability and cost efficiency.",

banks observed during 56 quarters, we test for Granger non-causality between banks’ profitability and cost efficiency.Ībstract = "This paper develops a new method for testing for Granger non-causality in panel data models with large cross-sectional (N) and time series (T) dimensions. This paper develops a new method for testing for Granger non-causality in panel data models with large cross-sectional (N) and time series (T) dimensions.

0 kommentar(er)

0 kommentar(er)